Interested in finding out the Net Asset Value (NAV) of our portfolio and the Internal Rate of Return (IRR) an investor would benefit from if he/she would have invested in every single campaign? Discover our calculations below.

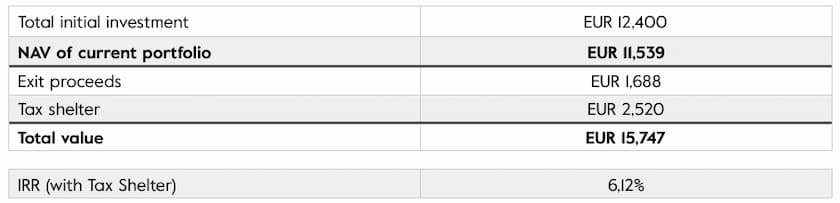

An investor who would have invested €100 in each campaign offered on the platform would have (up until today) paid a total of €12,400 and would have a portfolio with a net value of €11,539. This investor would have benefited from €1,699 thanks to loan reimbursments, paid interests and exits. He/She would have also gotten back €2,520 thanks to Tax Shelter, thus increasing the value of his/her portfolio to a total amount of €15,747. Today, he/she would benefit from an IRR of 6.12%.

The calculation of the NAV is based on the initial valuation of the company, except if a positive or negative event takes place after the investment - in that case, the valuation is reevaluated based on the new value of the event or put to 0. This calculation is also done on a fully diluted basis (taking into account all future conversion of convertible loans, warrants, stock option plans, etc).